Yes, America, There is a Class War, and You Just Lost It

“The Republican Party mainly represents the rich,” explains Cole. “It also reaches out to rural people and claims to help them, but it is all lies. It mainly represents the rich.” (Image: Shutterstock)

The Republican Party did not just overhaul the tax code and they did not cut “your” taxes. They engineered a coup against the middle and working classes and they threw enormous amounts of public money to private billionaires and multi-millionaires.

Americans do not understand this sort of con game because mostly they don’t understand social class. They often don’t even believe in the latter. But really, not all households in the US are equal. Some have more income than others. Some have more power than others. And as with the Trumps, that wealth and power can be passed on to the next generation.

We’re not all middle class. That would make a mockery of the word “middle,” which implies that there are lower and upper classes. Some of us are working class, some are middle class, some are upper middle class, and some are rich. Policies that help the rich by cutting their taxes do not help the working and middle classes. They actively harm the latter by making less money available for government services and by devaluing the dollar.

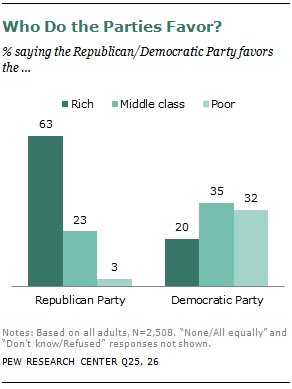

The Republican Party mainly represents the rich. It also reaches out to rural people and claims to help them, but it is all lies. It mainly represents the rich.

(Graph: h/t Pew) Alabama routinely votes Republican. Alabama is one of the poorest states in the country. The Republicans aren’t actually doing anything for Alabama, except maybe making them feel good about themselves by buttering them up, or indulging them in their weird idea that fundamentalist Christianity should dictate social policy to 320 million Americans, who do not share those values.

(Graph: h/t Pew) Alabama routinely votes Republican. Alabama is one of the poorest states in the country. The Republicans aren’t actually doing anything for Alabama, except maybe making them feel good about themselves by buttering them up, or indulging them in their weird idea that fundamentalist Christianity should dictate social policy to 320 million Americans, who do not share those values.

The rich in the United States use American highways, and American wifi, and depend on the FBI to keep them from getting kidnapped. But they don’t want to pay for those things. They want you to pay for them even though they use them much more. I get angry when I see those trucks on the highway with the sign that they payed $9277 in tolls and fees last year to be on the highway. Trucks are the ones that tear up the highways and force us to spend hundreds of millions of dollars to rebuild. Their fees and tolls don’t come close to paying for the damage they do. So the costs are offloaded.

Onto us?

Onto us.

There are about 126 million households in the United States. One percent of them would be 1.26 million households. That is about the size of the city of Los Angeles. There are one hundred groups of 1.26 million households in the US, i.e. 100 Los Angeleses worth of households. Those one hundred groups are not equal in wealth. The bottom 100th of American households doesn’t have a pot to pee in.

The Republican Party slavishly serves the top 1.26 million households. That’s who they report to. That’s who sent them to Congress, through their campaign donations. They don’t care about you and they did not just now do you any favors.

The wealthiest one percent owns about 38 percent of the privately held wealth in the United States. In the 1950s, the top 1% only owned about 25 percent of the privately held wealth. A Republican was in the White House, Dwight Eisenhower. He was not a left wing guy. But he worried about corporations combining with government officials to become way more powerful. The last time wealth inequality was this high was just before the Great Depression. Think about that.

Center for Budget & Policy Priorities

Center for Budget & Policy Priorities

Americans’ wealth amounts to about $88 trillion. If you divided up all the privately held wealth equally, every household in the US would be worth $698,000. That is, they’d all have their own home plus substantial investments.

But needless to say, the wealth isn’t divided up equally. The top ten percent of households, 12.6 million households own 76% of the privately held wealth. That is, 10 of our notional 100 Los Angeleses own three-fourths of the wealth.

So just to be clear, of our 100 Los Angeleses worth of households, 90 of them own only 24 percent of the wealth.

So how did the top one percent go from having 25% of the privately held wealth to having 38%?

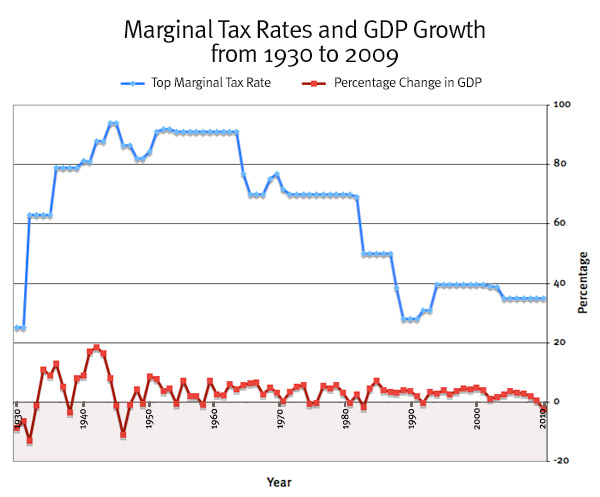

In some large part, it was tax policy. In the Eisenhower administration the top marginal tax rate was 91%, and the highest bracket of earners paid 90% in income tax. Progressive income tax was intended to keep the society from getting too out of kilter and to prevent wealth from becoming concentrated in a few hands.

SUPPORT COMMON DREAMS WITH AN YEAR-END CONTRIBUTION TODAY

Common Dreams has been bringing the progressive community the news that matters for over 20 years. We rely on support from thousands of small contributors to keep publishing. More people are reading Common Dreams than ever before but the number of readers contributing has remained flat. If everyone reading this gave our End-of-Year campaign a tax-deductible contribution right now, we would start 2018 strong.

(h/t Fact and Myth)

(h/t Fact and Myth)

There is no evidence, zero, that these tax policies hurt economic growth or hampered job creation.

Eisenhower’s tax policy was repealed over time, especially by Ronald Reagan. Reagan pulled the familiar scam of promising that tax cuts would pay for themselves by encouraging entrepreneurs to invest and to hire.

Instead, the government deficit ballooned (that’s what happens if you cut taxes but leave spending programs in place) .

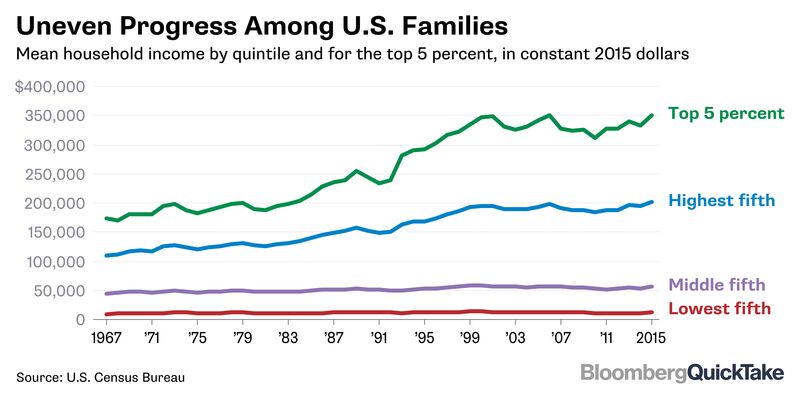

And not only were all boats not lifted by Reagan’s rising tide, most of them were sunk. The average wage of an average worker is not higher now than it was in 1970.

(Graph: Bloomberg)

(Graph: Bloomberg)

The economy has grown enormously since 1970. So if workers did not get a share in the newly created wealth, who has it?

The 1%?

The 1%.

Think about tax policy as a snowblower aimed at a single point. Snow builds up at the point where the snowblower is facing. If you keep aiming at that point as you clean the snow, you’ll get an enormous hill of snow. There will be no snow to speak of on the driveway. There will just be an artificial mountain.